UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantþ

[X]

Filed by a Party other than the Registranto

[ ]Check the appropriate box:

o | | |

| [ ] | | Preliminary Proxy Statement |

|

o[ ] | | Confidential, for Use of the Commission Only (as permitted by rule 14a-6(e)14a-6(e)(2)) |

|

þ[X] | | Definitive Proxy Statement |

|

o[ ] | | Definitive Additional Materials |

|

o[ ] | | Soliciting Material Pursuant to §240.14a-12 |

SUBURBAN PROPANE PARTNERS, L.P.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ | | | | | | |

| | | | | | |

| [X] | | No fee required. |

|

o[ ] | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | | Title of each class of securities to which transaction applies: |

(2) | |

| | | |

(2) | | Aggregate number of securities to which transaction applies: | | |

(3) | |

| | | |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) | |

| | | |

(4) | | Proposed maximum aggregate value of transaction: |

o | |

| | | |

[ ] | | Fee paid previously with preliminary materials. |

|

o[ ] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | | Amount Previously Paid: |

(2) | |

| | | |

(2) | | Form, Schedule or Registration Statement No.: |

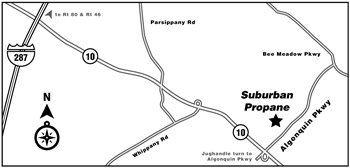

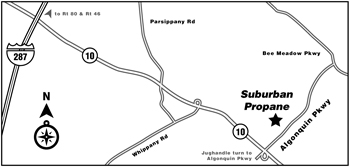

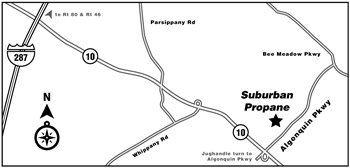

One Suburban Plaza • 240 Route 10 West • P.O. Box 206 • Whippany, NJ07981-0206

http://www.suburbanpropane.com

StivalaPresident and Chief Executive Officer

June 1, 2009

Dear Fellow Suburban Propane Unitholder:

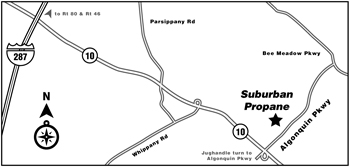

You are cordially invited to attend the Tri-Annual Meeting of the Limited Partners of Suburban Propane Partners, L.P. to be held on Wednesday, July 22, 2009,May 13, 2015, beginning at 9:00 a.m. at our executive offices at One Suburban Plaza, 240 Route 10 West, Whippany, New Jersey.

Whether or not you plan to attend in person, it is important that your units be represented at the meeting. You may vote on the matters that come before the meeting by completing the enclosed proxy card and returning it in the envelope provided.

Alternatively, you may also vote over the Internet or by telephone.Attendance at the Tri-Annual Meeting will be open to holders of record of common units as of the close of business on May 26, 2009.March 16, 2015. I look forward to greeting those of you who will be able to attend.

Sincerely,

Mark A. Alexander

Chief Executive Officer

| | | | |

| | | | Sincerely yours, |

| | |

| | | |  |

| | | | Michael A. Stivala |

| | | | President and Chief Executive Officer |

SUBURBAN PROPANE PARTNERS, L.P.

NOTICE OF TRI-ANNUAL MEETING

July 22, 2009

May 13, 2015

The Tri-Annual Meeting of the Limited Partners of Suburban Propane Partners, L.P. (“Suburban”) will be held at 9:00 a.m. on Wednesday, July 22, 2009,May 13, 2015, at our executive offices at One Suburban Plaza, 240 Route 10 West, Whippany, New Jersey, for the following purposes:

1. To elect six Supervisors;

2. To approve Suburban’s 2009 Restricted Unit Plan, including the authorization of the issuance of 1,200,000 common units of Suburban to be available for grant under the Plan;

3. To approve the adjournment of the Tri-Annual Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the Tri-Annual Meeting to approve Proposal 1 or Proposal 2 above; and

4. To consider any other matters that may properly come before the meeting.

| 1. | To elect seven Supervisors to three-year terms; |

| 2. | To ratify our independent registered public accounting firm for our 2015 fiscal year; |

| 3. | To approve an amendment to Suburban’s 2009 Restricted Unit Plan, authorizing the issuance of an additional 1,200,000 Common Units pursuant to awards granted under the Plan; |

| 4. | To provide our Limited Partners with the opportunity to cast an advisory vote on the compensation of our named executive officers; |

| 5. | To consider any other matters that may properly come before the meeting. |

Only holders of record of common units as of the close of business on May 26, 2009March 16, 2015 are entitled to notice of, and to vote at, the meeting.

By Order of the Board of Supervisors,

Paul Abel

Vice President, Secretary & General Counsel

June 1, 2009

| | | | |

| | By Order of the Board of Supervisors, Paul Abel Senior Vice President, Secretary & General Counsel | | |

March 20, 2015

IMPORTANT

Your vote is important. Whether or not you expect to attend the meeting in person, we urge you to complete and return the enclosed proxy card at your earliest convenience in the postage-paid envelope provided, or vote using the Internet or by telephone.

SUBURBAN PROPANE PARTNERS, L.P.

One Suburban Plaza

240 Route 10 West

Whippany, New Jersey07981-0206

QUESTIONS AND ANSWERS ABOUT THE TRI-ANNUAL MEETING

This Proxy Statement (first mailed,(which, together with a form of proxy, is being mailed or otherwise made available to Unitholders on or about June 1, 2009)March 20, 2015) is being furnished to holders of Common Units of Suburban Propane Partners, L.P., which we refer to as “Suburban,” “we” or “our,” in connection with the solicitation of proxies by the Board of Supervisors of Suburban, which we refer to as the “Board,” for use at Suburban’s Tri-Annual Meeting of Limited Partners and any continuations, postponements or adjournments thereof, which we refer to as the “Meeting.”

Q: When and where is the Meeting?

A:The Meeting will be held at 9:00 a.m. on Wednesday, May 13, 2015, at our executive offices at One Suburban Plaza, 240 Route 10 West, Whippany, New Jersey.

Q: What is the purpose of the Meeting?

A: At the Meeting, holders of Common Units, whom we refer to as “Unitholders,” will be asked to consider and vote on the following four proposals:

| | |

Q: | | When and where is the Meeting? |

| |

A:— | | The Meeting will be held at 9:00 a.m. on Wednesday, July 22, 2009, at our executive offices at One Suburban Plaza, 240 Route 10 West, Whippany, New Jersey. |

| |

Q: | | What is the purpose of the Meeting? |

|

A: | | At the Meeting, holders of Common Units, whom we refer to as Unitholders, will be asked to consider and vote on the following three proposals: |

|

| | • PROPOSAL NO. 1—– To elect sixseven Supervisors to three-year terms, which we refer to as the Election“Election Proposal. |

| |

| — | | • PROPOSAL NO. 2 – To ratify our independent registered public accounting firm for our 2015 fiscal year, which we refer to as the “Accountant Ratification Proposal.” |

| — | | PROPOSAL NO. 3 – To approve Suburban’s 2009 Restricted Unit Plan, including the authorization of the issuance of 1,200,000 Common Unitsan amendment to be available for grant under theSuburban’s 2009 Restricted Unit Plan, which we refer to as the Restricted Unit“Plan,” increasing by an additional 1,200,000 Common Units the number of Common Units subject to awards under the Plan, Proposal. |

|

| | • PROPOSAL NO. 3— To approve the adjournment of the Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the Tri-Annual Meeting to approve the Election Proposal or the Restricted Unit Plan Proposal, which we refer to as the Adjournment“Restricted Unit Plan Proposal.

” |

| |

Q:— | | How doesPROPOSAL NO. 4 – To provide our Unitholders with the Board recommend Iopportunity to cast an advisory vote on the proposals? |

|

A: | | The Board recommends a voteFOReachcompensation of its nominees for Supervisor, approval of the Restricted Unit Plan Proposal and approval of the Adjournment Proposal. |

|

Q: | | How will voting on any other business be conducted? |

|

A: | | The Board of Supervisors does not know of any business to be considered at the meeting other than the proposals described in this Proxy Statement. However, if any other business is properly presented, your signed proxy card gives authority to the personsour named in the proxy to vote on these matters at their discretion. |

|

Q: | | Who is entitled to vote? |

|

A: | | Each holder of Common Units as of the close of business on May 26, 2009,executive officers, which we refer to as the Record Date, is entitled to vote at the Meeting.“Say-on-Pay Proposal.” |

Q: How does the Board recommend I vote on the proposals?

A: The Board unanimously recommends a voteFOReach of its nominees for Supervisor, approval of the Accountant Ratification Proposal, approval of the Restricted Unit Plan Proposal and approval of the Say-on-Pay Proposal.

Q: How will voting on any other business be conducted?

A: The Board of Supervisors does not know of any business to be considered at the Meeting other than the proposals described in this Proxy Statement. However, if any other business is properly presented, your signed proxy card gives authority to the persons named in the proxy to vote on these matters at their discretion.

Q: Who is entitled to vote?

A: Each holder of Common Units as of the close of business on March 16, 2015, which we refer to as the “Record Date,” is entitled to vote at the Meeting.

Q: How many Common Units may be voted?

A:As of the Record Date, 60,459,026 Common Units were outstanding. Each Common Unit entitles its holder to one vote.

Q: What is a “quorum”?

A: There must be a quorum for the Meeting to be held. A quorum will be present if a majority of the outstanding Common Units as of the Record Date is represented in person or by proxy at the Meeting. If you submit a properly executed proxy card, even if you mark WITHHOLD or ABSTAIN, then you will be considered part of the quorum.

Q: What vote is required to approve the proposals?

A:

| |

Q:— | | How many Common Units may be voted? |

| |

A: | | As of the Record Date, 32,795,355 Common Units were outstanding. Each Common Unit entitles its holder to one vote. |

|

Q: | | What is a“quorum”?

|

|

A: | | There must be a quorum for the meeting to be held. A quorum will be present if a majority of the outstanding Common Units is represented in person or by proxy at the meeting. If you submit a properly executed proxy card, even if you abstain from voting, then you will be considered part of the quorum. However, abstentions are not counted in the tally of votes FOR or AGAINST a proposal. |

| | |

Q: | | What vote is required to approve the proposals? |

|

A: | | |

|

| | • PROPOSAL NO. 1 —– Under the Third Amended and Restated Agreement of Limited Partnership (as amended) of Suburban, as further amended, which we refer to as our Partnershipthe “MLP Agreement,” the affirmative vote of holders of a plurality of the Common Units represented in person or by proxy at the Meeting is required to elect each Supervisor.

|

| | — | | PROPOSAL NO. 2– Under the MLP Agreement, the affirmative vote of a majority of Common Units entitled to vote at the Meeting and present, whether in person or by proxy, is required to approve the Accountant Ratification Proposal. |

| — | •

| PROPOSAL NO. 2 —3 – Under the rules of the New York Stock Exchange, which we refer to as the affirmative vote of a majority of“NYSE,” the votes cast by the Unitholders, whether in person or by proxy, provided that the total votes cast on the proposal represent more than 50% of all Common Units entitled to vote thereon, is required to approve the Restricted Unit Plan Proposal. |

|

| | • PROPOSAL NO. 3 — The affirmative vote of a majority of the votes cast by the Unitholders, whether in person or by proxy, is required to approve the AdjournmentRestricted Unit Plan Proposal.

|

| |

Q:— | | How do I vote?PROPOSAL NO. 4 – Under the MLP Agreement, the affirmative vote of a majority of Common Units entitled to vote at the Meeting and present, whether in person or by proxy, is required to approve the Say-on-Pay Proposal. |

Q: How are withholds, abstentions and broker non-votes counted for the proposals?

A: For the Election Proposal, Supervisors are elected by a plurality of FOR votes. Accordingly, a proxy card marked as WITHHOLD and a broker non-vote will not count towards the plurality required to elect a Supervisor. For the Restricted Unit Plan Proposal, a proxy card marked ABSTAIN has the same effect as a vote AGAINST such proposal, but a broker non-vote is not counted in the tally of votes FOR or AGAINST such proposal and does not affect the voting results for such proposal. For each of the Accountant Ratification Proposal and Say-on-Pay Proposal, a proxy card marked ABSTAIN has the same effect as a vote AGAINST such proposal, but a broker non-vote is not counted as entitled to vote at the Meeting and does not affect the voting results for such proposal.

Q: How do I vote?

A: You may vote by any one of three different methods:

| |

A:— | | You may vote by any one of three different methods: |

| |

| | • In Writing. You can vote by marking, signing and dating the enclosed proxy card and returning it in the enclosed envelope. |

| |

| — | | • By Telephone and Internet. You can vote your proxies by touchtone telephone from the USA, US territories or Canada or through the Internet. Please follow the instructions on the enclosed proxy card. |

| |

| — | | • In Person. You can vote by attending the Meeting. |

Common Units represented by properly executed proxies that are not revoked will be voted in accordance with the instructions shown on the proxy card. If you return your signed proxy card but do not give instructions as to how you wish to vote, your Common Units will be votedFOReach Supervisor nominee and each of the Accountant Ratification Proposal, the Restricted Unit Plan Proposal and the Say-on-Pay Proposal.

Our Board of Supervisors urges Unitholders to complete, date, sign and return the accompanying proxy card, or to submit a proxy by telephone or over the Internet by following the instructions included with your proxy card, or, in the event you hold your Common Units through a broker or other nominee, by following the separate voting instructions received from your broker or nominee. Your broker or nominee may provide proxy submission through the Internet or by telephone. Please contact your broker or nominee to determine how to vote.

Q: What do I do if I want to change my vote?

A: You have the right to revoke your proxy at any time before the Meeting by:

| |

| — | | Common Units represented by properly executed proxies that are not revoked will be voted in accordance with the instructions shown on the proxy card. If you return your signed proxy card but do not give instructions as to how you wish to vote, your Common Units will be votedFOReach of the proposals.Notifying our Company Secretary; |

| |

| — | | Our Board of Supervisors urges Unitholders to complete, date, sign and return the accompanying proxy card, or to submit a proxy by telephone or over the Internet by following the instructions included with your proxy card, or, in the event you hold your Common Units through a broker or other nominee, by following the separate voting instructions received from your broker or nominee. Your broker or nominee may provide proxy submission through the Internet or by telephone. Please contact your broker or nominee to determine how to vote. |

| | |

Q: | | What do I do if I want to change my vote? |

| |

A: | | You have the right to revoke your proxy at any time before the meeting by: |

| | |

| | • Notifying our Partnership Secretary; |

|

| | • Voting in person; or |

| |

| — | | • Returning a later-dated proxy card. |

Attendance at the Meeting will not, in and of itself, revoke your proxy.

| | |

Q: | | What does it mean if I receive more than one proxy card? |

|

A: | | If your Common Units are registered differently and/or are in more than one account, you will receive more than one proxy card. Please mark, sign, date and return all of the proxy cards you receive to ensure that all of your Common Units are voted. We encourage you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting our transfer agent, Computershare Investor Services, P.O. Box 43078, Providence, RI02940-3078 (mail), Computershare Investor Services, 250 Royall Street, Canton, MA 02021 (overnight delivery) or telephone781-575-2724. The hearing impaired may contact Computershare at TDD800-952-9245. |

2

Q: What does it mean if I receive more than one proxy card?A:If your Common Units are registered differently and/or are in more than one account, you will receive more than one proxy card. Please mark, sign, date and return all of the proxy cards you receive to ensure that all of your Common Units are voted. We encourage you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting our transfer agent, Computershare Investor Services, P. O. Box 30170, College Station, TX 77842-3170 (mail), Computershare Investor Services, 211 Quality Circle, Suite 210, College Station, TX 77845 (overnight delivery) or telephone 781-575-2724. The hearing impaired may contact Computershare at TDD 800-952-9245.

| | |

Q: | | What do I do if my Common Units are held in “street name”? |

|

A: | | If your Common Units are held in the name of your broker, a bank or other nominee, that party will give you instructions about how to vote your Common Units. |

|

Q: | | Who will count the votes? |

|

A: | | Representatives of Computershare Trust Company, N.A., our transfer agent and an independent tabulator, will count the votes and act as the inspector of election. |

|

Q: | | Who is bearing the cost of this proxy solicitation? |

|

A: | | Q: What do I do if my Common Units are held in “street name”? A: If your Common Units are held in the name of your broker, a bank or other nominee, that party will give you instructions about how to vote your Common Units. Q: Who will count the votes? A: Representatives of Computershare Trust Company, N.A., our transfer agent and an independent tabulator, will count the votes and act as the inspector of election. Q: Who is bearing the cost of this proxy solicitation? A:The Board of Supervisors is soliciting your proxy on behalf of Suburban. We are bearing the cost of soliciting proxies for the Meeting. Georgeson Inc. has been retained to assist in the distribution of proxy materials and the solicitation of votes and will be paid a customary fee for its services totaling approximately $15,000, plus reasonable out-of-pocket expenses. In addition to using the mail, our Supervisors, officers and employees may solicit proxies by telephone, personal interview or otherwise. They will not receive additional compensation for this activity, but may be reimbursed for their reasonable out-of-pocket expenses. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to Unitholders. |

|

Q: | | Will the independent registered public accountants attend the Meeting? |

|

A: | | Representatives of PricewaterhouseCoopers LLP, our independent registered public accounting firm for the fiscal years ended September 27, 2008 and ending September 26, 2009, will attend the Meeting, will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions. |

|

Q: | | When are the Unitholder proposals for the next meeting of Unitholders due? |

|

A: | | We presently expect that our next Tri-Annual Meeting will be held in April 2012. If a Unitholder intends to present any proposals for inclusion in Suburban’s proxy statement in accordance withRule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended, for consideration at the Company’s 2012 Tri-Annual Meeting, the proposal must be received at Suburban’s principle executive offices by October 31, 2011. |

|

| | In accordance with the Partnership Agreement, if a Unitholder intends, at the 2012 Tri-Annual Meeting, to nominate a person for election to the Board of Supervisors, the Unitholder must deliver notice thereof to the Board of Supervisors not earlier than the close of business on December 23, 2011 and not later than January 17, 2012. A different notice deadline will apply for the nomination of persons for election to the Board of Supervisors if the date of the 2012 Tri-Annual Meeting is not publicly announced by Suburban more than 100 days prior to the date of such meeting. Such deadline, and the procedures that a Unitholder must follow to nominate a person for election to the Board of Supervisors, are further described below under the heading “Supervisor Nominations and Criteria for Board Meetings — Unitholder Nominations.” |

|

| | If we do not receive notice of any Unitholder proposal for the 2012 Tri-Annual Meeting by January 17, 2012, then Suburban’s proxy may confer discretionary authority on the persons being appointed as proxies to vote on such proposals. |

|

| | If the date of the 2012 Tri-Annual Meeting is changed to a different month, we will advise our Unitholders of the new date for the submission of Unitholder proposals in our earliest possible quarterly report onForm 10-Q filed with the Securities and Exchange Commission. |

|

Q: | | Where and when will I be able to find the voting results? |

|

A: | | In addition to announcing the results at the Meeting, we will post the results on our web site atwww.suburbanpropane.com within two days after the Meeting. You will also be able to find the results in our Annual Report onForm 10-K for our fiscal year ending September 26, 2009, which we will file with the Securities and Exchange Commission in November 2009. |

3

| | |

Q: | | How can I obtain a copy of our 2008 Annual Report onForm 10-K? |

|

A: | | We will provide an additional copy of our 2008 Annual Report onForm 10-K, including the financial statements and financial statement schedule filed therewith, without charge, upon written request to Investor Relations, Suburban Propane Partners, L.P., 240 Route 10 West, P.O. Box 206, Whippany, New Jersey07981-0206. We will furnish a requesting Unitholder with any exhibit not contained therein upon payment of a reasonable fee, which fee shall be limited to our reasonable expenses in furnishing such exhibit. |

|

Q: | | Who can I contact for further information? |

|

A: | | If you need assistance in voting your Common Units, please call the firm assisting us in the solicitation of proxies for the Meeting: |

Georgeson Inc.

199 Water Street, has been retained to assist in the distribution of proxy materials and the solicitation of votes and will be paid a customary fee for its services totaling approximately $10,000, plus reasonable out-of-pocket expenses. In addition to using the mail, our Supervisors, officers and employees may solicit proxies by telephone, personal interview or otherwise. They will not receive additional compensation for this activity, but may be reimbursed for their reasonable out-of-pocket expenses. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to Unitholders.Q: Will the independent registered public accountants attend the Meeting?

A: Representatives of PricewaterhouseCoopers LLP, our independent registered public accounting firm, are expected to attend the Meeting, will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

Q: Does Suburban’s proxy confer discretionary authority to vote on Unitholder proposals at the Meeting?

A: With respect to any Unitholder proposal submitted outside of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act,” and for which we did not receive notice by a reasonable time before the date of this proxy statement, Suburban’s proxy confers discretionary authority on the persons being appointed as proxies to vote on such proposal.

Q: When are the Unitholder proposals for the next meeting of Unitholders due?

A: We presently expect that our next Tri-Annual Meeting will be held in May 2018. If a Unitholder intends to present any proposals for inclusion in Suburban’s proxy statement in accordance with Rule 14a-8 for consideration at Suburban’s 2018 Tri-Annual Meeting, the proposal must be received at Suburban’s principal executive offices by November 20, 2017.

In accordance with the MLP Agreement, if a Unitholder intends, at the 2018 Tri-Annual Meeting, to nominate a person for election to the Board of Supervisors, the Unitholder must deliver notice thereof to the Board of Supervisors not earlier than the close of business on the 120th day before, and not later than the close of business on the 90th day before, the date of the 2018 Tri-Annual Meeting. A different notice deadline will apply for the nomination of persons for election to the Board of Supervisors if the date of the 2018 Tri-Annual Meeting is not publicly announced by Suburban more than 100 days prior to the date of such meeting. Such deadline, and the procedures that a Unitholder must follow to nominate a person for election to the Board of Supervisors, are further described below under the heading “Supervisor Nominations and Criteria for Board Meetings – Unitholder Nominations.”

Q: Where and when will I be able to find the voting results?

A: In addition to announcing the results at the Meeting, we will post the results on our web site atwww.suburbanpropane.com within two days after the Meeting. You will also be able to find the results in our Current Report on Form 8-K that we will file with the Securities and Exchange Commission within four business days following conclusion of the Meeting.

Q: How can I obtain an additional copy of our 2014 Annual Report on Form 10-K?

A: We will provide an additional copy of our 2014 Annual Report on Form 10-K, including the financial statements and financial statement schedule filed therewith, without charge, upon written request to

Investor Relations, Suburban Propane Partners, L.P., 240 Route 10 West, P.O. Box 206, Whippany, New Jersey 07981-0206. We will furnish a requesting Unitholder with any exhibit not contained therein upon payment of a reasonable fee, which fee shall be limited to our reasonable expenses in furnishing such exhibit.

Q: Who can I contact for further information?

A: If you need assistance in voting your Common Units, please call the firm assisting us in the solicitation of proxies for the Meeting:

Georgeson Inc.

480 Washington Blvd, 26th Floor

New York, NY10038-3560

Banks and Brokers Call(212) 440-9800

All Others Call

Jersey City, NJ 07310

In the US, call Toll Free(800) 213-0409

| | |

Q: | | What can I do if I and another Unitholder with whom I live want to receive two copies of this proxy statement? |

|

A: | | In order to reduce our printing and postage costs, Unitholders who share a single address will receive only one copy of this proxy statement at that address unless we have received instructions to the contrary from any Unitholder at that address. However, if a Unitholder residing at such an address wishes to receive a separate copy of this proxy statement or of future proxy statements (as applicable), he or she may contact Investor Relations, Suburban Propane Partners, L.P., P.O. Box 206, Whippany, New Jersey07981-0206. We will deliver separate copies of this proxy statement promptly upon written or oral request. If you are a Unitholder receiving multiple copies of our proxy statement, you can request to receive only one copy by contacting us in the same manner. If you own your Common Units through a bank, broker or other Unitholder of record, you may request additional or fewer copies of this proxy statement by contacting the Unitholder of record. |

4

Outside of the US, call 781-575-2137Q: What can I do if I and another Unitholder with whom I live want to receive two copies of this proxy statement?

A:In order to reduce our printing and postage costs, Unitholders who share a single address will receive only one copy of this proxy statement at that address unless we have received instructions to the contrary from any Unitholder at that address. However, if a Unitholder residing at such an address wishes to receive a separate copy of this proxy statement or of future proxy statements (as applicable), he or she may contact Investor Relations, Suburban Propane Partners, L.P., P.O. Box 206, Whippany, New Jersey 07981-0206. We will deliver separate copies of this proxy statement promptly upon written or oral request. If you are a Unitholder receiving multiple copies of our proxy statement, you can request to receive only one copy by contacting us in the same manner. If you own your Common Units through a bank, broker or other Unitholder of record, you may request additional or fewer copies of this proxy statement by contacting the Unitholder of record.Q: Why did I receive a notice in the mail regarding Internet availability of proxy materials instead of a full set of proxy materials?

A:Pursuant to rules adopted by the Securities and Exchange Commission, we have elected to furnish this proxy statement and other proxy materials to certain Unitholders on the Internet rather than by mailing paper copies. If you received an Important Notice Regarding the Availability of Proxy Materials, which we refer to as a “Notice,” in the mail, you will not receive a paper copy of these materials unless you expressly request to receive a paper copy. All Unitholders have the ability to access this proxy statement and other proxy materials on the Internet. Instructions on how to do so, or on how to request a paper copy, may be found in the Notice. In addition, Unitholders may request to receive these materials in printed form by mail on an ongoing basis. The Notice will also instruct you on how you may vote your Common Units, including how you may vote over the Internet.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

This Proxy Statement and the accompanying Annual Report to Unitholders are available atwww.suburbanpropane.comwww.envisionreports.com/sph.

If you plan on attending the Meeting to vote in person, and need directions to our headquarters pleasecall 973-887-5300.

MANAGEMENT SUCCESSION PLAN

On April 23, 2009, we announced that Suburban’s President, Michael J. Dunn Jr., will takeare printed on the added responsibilities of Chief Executive Officer when our next fiscal year begins on September 27, 2009. Mr. Dunn joined Suburban in 1997, became a Supervisor in 1998, and has served as President since 2005. He will succeed Mark A. Alexander, who will continue as a consultant to the Board for a term of three years. Mr. Alexander has served as Suburban’s only Chief Executive Officer, and as a Supervisor, since Suburban went public in 1996. This change is the key element of the management succession plan developed by the Compensation Committee of Suburban’s Board and Mr. Alexander to ensure that the executive leadership of Suburban evolves in a clearly defined and disciplined manner. In accordance with this plan, Mr. Alexander will not be seeking election as a Supervisor at the Meeting and will transfer to Mr. Dunn his sole membership interest in Suburban’s General Partner.accompanying proxy card. For information regarding Mr. Alexander’s consulting and separation arrangements, see “Mr. Alexander’s Employment Agreement and Consulting and Separation Agreement” in “Compensation Discussion and Analysis” below.

additional directions, please call 973-887-5300.

ELECTION OF SUPERVISORS

(Proposal No. 1 on the Proxy Card)

In connection with the decision of our Chief Executive Officer, Mark A. Alexander, not to stand for electionPursuant to the Board of Supervisors at the Meeting, our Board of Supervisors, pursuant to discretion granted to the Board under our PartnershipMLP Agreement, reduced the size of the Board from seven to six, effective upon the conclusion of the Meeting. Unitholders are entitled to elect all six members of the Board of Supervisors, (the “Supervisors”). which we refer to as “Supervisors,” who are nominated at the Meeting. Dudley C. Mecum, a Supervisor whose current term expires upon conclusion of the Meeting, has informed the Board that he will retire at the conclusion of his term and not stand for re-election at the Meeting. Acting on the recommendation of its Nominating/Governance Committee, at its meeting on January 21, 2015 our Board decided to nominate the remaining seven current Supervisors for re-election at the Meeting and leave vacant for the foreseeable future the position being vacated by Mr. Mecum.

The seven nominees for Supervisors, all of whom are currently serving as Supervisors, are described below (as of May 22, 2009)March 16, 2015). If elected, all nominees are expected to serve until the 20122018 Tri-Annual Meeting and until their successors are duly elected. Although the Board does not anticipate that any of the persons named below will be unable to stand for election, if for any reason a nominee becomes unavailable for election, the persons named in the form of proxy have advised that they will vote for such substitute nominee as the Board may propose. In accordance with our Corporate Governance Guidelines and Principles (described more fully below) and the rules of the New York Stock Exchange, we have affirmatively determined that our Board of Supervisors is currently composed of a majority of independent directors, and that the following directors and nominee directorsnominees are independent: Harold R. Logan, Jr., John Hoyt Stookey, Dudley C. Mecum, John D. Collins, Jane Swift, Lawrence C. Caldwell and Jane Swift.

NOMINEES FOR ELECTION AS SUPERVISORS

Harold R. Logan, Jr. Age 64 | | | | |

Harold R. Logan, Jr. | | | Age 70 | |

Mr. Logan has served as a Supervisor since March 1996 and was elected as Chairman of the Board of Supervisors in January 2007. Mr. Logan is a Co-Founder and, from 2006 to the present has been serving as a Director, of Basic Materials and Services LLC, an investment company that has invested in companies that provide specialized infrastructure services and materials for the pipeline construction industry and the sand/silica industry. From 2003 to September 2006, Mr. Logan was a Director and Chairman of the Finance Committee of the Board of Directors of TransMontaigne Inc., which provided logistical services (i.e. pipeline, terminaling and marketing) to producers and end-users of refined petroleum products. From 1995 to 2002, Mr. Logan was Executive Vice President/Finance, Treasurer and a Director of TransMontaigne Inc. From 1987 to 1995, Mr. Logan served as Senior Vice President of– Finance and a Director of Associated Natural Gas Corporation, an independent gatherer and marketer of natural gas, natural gas liquids and crude oil. Mr. Logan is also a Director of InfraREIT, Inc., Cimarex Energy Co., Graphic Packaging Holding Company and Hart Energy Publishing LLPLLP.

Over the past forty years, Mr. Logan’s education, investment banking/venture capital experience and Cimarex Energy Co.

5

John Hoyt StookeyAge 78 Mr. Stookey has served as a Supervisor since March 1996. He was Chairman of the Board of Supervisors from March 1996 through January 2007. From 1986 until September 1993, he was the Chairman, President and Chief Executive Officer of Quantum Chemical Corporation,

(“Quantum”), a predecessor of

Suburban.Suburban which we refer to as “Quantum.” He served as non-executive Chairman and a Director of Quantum from its acquisition by Hanson plc in September 1993 until October 1995, at which time he retired. Since then,

Mr. Stookey has served as a trustee forof a number of non-profit organizations, including founding and serving as non-executive Chairman of Per Scholas Inc. (a non-profit organization dedicated to using technologytraining inner city individuals to improve the lives of residents of the South Bronx)become computer and software technicians), The Berkshire Choral Festival and Landmark Volunteers (places high school students in volunteer positions with non-profit organizations during summer vacations) and has also servedcurrently serves on the Board of Directors of The Clark Foundation and The Robert Sterling Clark Foundation and The Berkshire Taconic Community Foundation.

Dudley C. MecumAge 73 Mr. Mecum has served as a

Supervisor since June 1996. He has beenLife Trustee of the Boston Symphony Orchestra.Mr. Stookey’s qualifications to sit on our Board include his extensive experience as Chief Executive Officer of four corporations (including a managingpredecessor of Suburban) and his many years of service as a director of Capricorn Holdings, LLC (a sponsor ofpublicly-owned corporations and investor in leveraged buyouts) since June 1997. Mr. Mecum was a partner of G.L. Ohrstrom & Co. (a sponsor of and investor in leveraged buyouts) from 1989 to June 1996.

John D. CollinsAge 70 non-profit organizations.Mr. Collins has served as a Supervisor since April 2007. He served with KPMG LLP, an international accounting firm, from 1962 until 2000, most recently as senior audit partner of its New York office. He has served as a United States representative on the International Auditing Procedures Committee, a committee of international accountants responsible for establishing international auditing standards. Until recently, Mr. Collins iswas a Director of Montpelier Re, Columbia Atlantic Funds and Mrs. Fields Original Cookies, Inc.

Mr. Collins’ qualifications to sit on our Board, and Columbia Atlantic Funds, and servesserve as Chairman of its Audit Committee, include his 40 years of experience in public accounting, including 31 years as a Trusteepartner supervising the audits of LeMoyne College.

Jane SwiftAge 44 public companies. Mr. Collins has served on a number of AICPA and international accounting and auditing standards bodies.Ms. Swift has served as a Supervisor since April 2007. She is currently the founderCEO of Middlebury Interactive Languages, LLC, a marketer of world language products. From 2010 through July 2011, Ms. Swift served as Senior Vice President – ConnectEDU Inc., a private education technology company. In 2007, she founded WNP Consulting, LLC, providinga provider of expert advice and guidance to early stage education companies. From 2003 —to 2006 she was a General Partner at Arcadia Partners, a venture capital firm focused on the education industry. She currently serveshas previously served on the boards of K12, Inc., Animated Speech Company and The Young Writers Project, and currently serves on the board of Sally Ride Science Inc., and severalnot-for-profit boards, including The Republican Majoritythe National Alliance for Choice and Landmark Volunteers, Inc.Public Charter Schools. Ms. Swift is also a Trustee for Champlain College. Prior to joining Arcadia, Ms. Swift served for 15fifteen years in Massachusetts state government, becoming Massachusetts’ first femalewoman governor in 2001.

Michael J. Dunn, Jr. Age 59 Ms. Swift’s qualifications to sit on our Board include her strong skills in public policy and government relations and her extensive knowledge of regulatory matters arising from her fifteen years in state government.

| | | | |

Lawrence C. Caldwell | | | Age 68 | |

Mr. DunnCaldwell has served as a Supervisor since November 2012. He was a Co-Founder of New Canaan Investments, Inc., which we refer to as “NCI,” a private equity investment firm, where he was one of three senior officers of the firm from 1988 to 2005. NCI was an active “fix and build” investor in packaging, chemicals, and automotive components companies. Mr. Caldwell held a number of board directorships and senior management positions in these companies until he retired in 2005. The largest of these companies was Kerr Group, Inc., a plastic closure and bottle company where Mr. Caldwell served as Director for eight years and Chief Financial Officer for six years. From 1985 to 1988, Mr. Caldwell was head of acquisitions for Moore McCormack Resources, Inc., an oil and gas exploration, shipping, and construction materials company. Mr. Caldwell is currently a director of Magnuson Products, LLC, a private company which manufactures specialty engine components for automotive original equipment manufacturers and aftermarket. Mr. Caldwell also currently serves on the Board of Trustees and as Chairman of the Investment and Finance Committee of Historic Deerfield, and on the Board of Directors and as Chairman of both the Finance and Strategic Planning Committees of the Leventhal Map Center; both of which non-profit institutions focus on enriching educational programs for K-12 children locally and nationwide.

Mr. Caldwell’s qualifications to sit on our Board include over forty years of successful investing in and managing of a broad range of public and private businesses in a number of different industries. This experience has encompassed both turnaround situations, and the building of companies through internal growth and acquisitions.

Mr. Chanin has served as a Supervisor since November 2012. He was Senior Managing Director of Prudential Investment Management, a subsidiary of Prudential Financial, Inc., from 1996 until his retirement in January 2012. He headed the firm’s private fixed income business, chaired an internal committee responsible for strategic investing and was a principal in Prudential Capital Partners, the firm’s mezzanine investment business. He currently serves as a Director of two private companies that are in Prudential Capital Partners funds’ portfolios, and provides consulting services to Prudential and one other client.

Mr. Chanin’s qualifications to sit on our Board include 35 years of investment experience with a focus on highly structured private placements in companies in a broad range of industries, with a particular focus on energy companies. He has previously served on the audit committee of a public company board and is currently a member of the audit committee for a private company board. Mr. Chanin has earned an MBA and is a Chartered Financial Analyst.

Mr. Stivala has served as our President since April 2014 and as our Chief Executive Officer since September 2014. Mr. Stivala has served as a Supervisor since November 2014. From November 2009 until March 2014 he was our Chief Financial Officer, and, before that, our Chief Financial Officer and Chief Accounting Officer since October 2007. Prior to that he was our Controller and Chief Accounting Officer since May 2005 and as a SupervisorController since July 1998. From June 1998 until May 2005 he was Senior Vice President, becoming Senior Vice President — Corporate Development in November 2002. He was Vice President — Procurement and Logistics from March 1997 until June 1998.December 2001. Before joining Suburban, he held several positions with PricewaterhouseCoopers LLP, an international accounting firm, most recently as Senior Manager in the Assurance practice.

Mr. Dunn was ViceStivala’s qualifications to sit on our Board include his thirteen years of experience in the propane industry, including as our current President of Commodity Trading for the investment banking firm of Goldman Sachs & Company.

As described above under “Management Succession Plan,” Mr. Dunn will assume the additional responsibilities ofand Chief Executive Officer of Suburban at the commencementand, before that, as our Chief Financial Officer for almost 7 years, which day to day leadership roles have provided him with intimate knowledge of our 2010 fiscal year (September 27, 2009) and Mr. Alexander will transfer to him the sole membership interest in Suburban’s General Partner.

operations.Vote Required and Recommendation of the Board of Supervisors

Under the PartnershipMLP Agreement, the affirmative vote of holders of a plurality of the Common Units represented in person or by proxy at the Meeting is required to elect each Supervisor. The Board of Supervisors unanimously recommends a voteFORthe election of each of the above nominees.

6

EXECUTIVE OFFICERS OF SUBURBAN

The following table sets forth certain information with respect to our executive officers as of May 22, 2009.March 16, 2015. Officers are appointed by the Board of Supervisors for one-year terms.

| | | | | | |

Name | | Age | | | | | | | Position With Suburban |

Name

Michael A. Stivala | | Age

45 | | Position with Suburban

|

|

Mark A. Alexander | | | 50 | | | President and Chief Executive Officer; Member of the Board of Supervisors |

Michael J. Dunn, Jr. Mark Wienberg | | 52 | 59 | | | President; Member of the Board of SupervisorsChief Operating Officer |

Michael A. StivalaKuglin | | 45 | 40 | | | Chief Financial Officer and& Chief Accounting Officer |

A. Davin D’Ambrosio | | | 45 | | | Vice President and Treasurer |

Paul Abel | | 61 | 56 | | | Senior Vice President, General Counsel and Secretary |

Mark Anton, II | | | 51 | | | Vice President — Business Development |

Steven C. Boyd | | 50 | 45 | | | Senior Vice President —– Field Operations |

Douglas T. Brinkworth | | 53 | 47 | | | Senior Vice President —– Product Supply, Purchasing & Logistics |

Michael M. Keating | | 61 | 55 | | | Senior Vice President |

Neil E. Scanlon | | 49 | | | | Senior Vice President — Human Resources and Administration |

Mark Wienberg | | | 46 | | | Vice President — Operational Planning |

Neil Scanlon | | | 43 | | | Vice President —– Information Services |

Michael KuglinA. Davin D’Ambrosio | | 51 | 39 | | | Vice President and Treasurer |

Sandra N. Zwickel | | 48 | | | | Vice President – Human Resources |

Daniel S. Bloomstein | | 42 | | | | Controller |

Mr. Alexanderhas served as Chief Executive Officer and as a Supervisor since March 1996, and served as President from October 1996 until May 2005. He was Executive Vice Chairman from March 1996 through October 1996. From 1989 until joining Suburban in 1996, Mr. Alexander served in various offices at Hanson Industries (the United States management division of Hanson plc, a global diversified industrial conglomerate), most recently Senior Vice President — Corporate Development. Mr. Alexander is the sole member of Suburban’s General Partner. Mr. Alexander is a Director of Kaydon Corporation and a member of its Compensation and Corporate Governance and Nominating Committees.

As discussed above under “Management Succession Plan,” Mr. Alexander will be stepping down from the role of Chief Executive Officer of Suburban at the conclusion of our 2009 fiscal year (September 26, 2009) and transferring his sole membership interest in Suburban’s General Partner to Mr. Dunn. Mr. Alexander’s service as a Supervisor will cease at the conclusion of the Meeting.

For Mr. Dunn’sStivala’s biographical information, see “Nominees for Election as Supervisors” above.

Mr. StivalaWienberg has served as our Chief Financial Officer and Chief AccountingOperating Officer since October 2007. Prior toApril 2014 and before that he was Controller and Chief Accounting Officer since May 2005 and Controller since December 2001. Before joining Suburban, he held several positions with PricewaterhouseCoopers LLP, an international accounting firm, most recently as Senior Manager in the Assurance practice. Mr. Stivala is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants.

Mr. D’Ambrosiohas served as Treasurer since November 2002 and was additionally made aour Vice President in October 2007. He served as Assistant Treasurer from October 2000 to November 2002– Operational Support and as Director of Treasury Services from January 1998 to October 2000. Mr. D’Ambrosio joined Suburban in May 1996 after 10 years in the commercial banking industry.

Mr. Abelhas served as General Counsel and Secretary since June 2006 and was additionally made aAnalysis (formerly Vice President in October 2007. From May 2005 until June 2006, Mr. Abel was Assistant General Counsel of Velocita Wireless, L.P., the owner and operator of a nationwide wireless data network. From 1998 until May 2005, Mr. Abel was Vice President, Secretary and General Counsel of AXS-One Inc. (formerly known as Computron Software, Inc.), an international business software company.

Mr. Antonhas served as Vice President — Business Development since he joined Suburban in 1999. Prior to joining Suburban, Mr. Anton worked as an Area Manager for another large multi-state propane marketer and was a Vice President at several large investment banking organizations.

7

Mr. Boyd has served as Vice President — Operations since October 2008. Prior to that he was Southeast and Western Area Vice President since March 2007, Managing Director — Area Operations since November 2003 and Regional Manager — Northern California since May 1997. Mr. Boyd held various managerial positions with predecessors of Suburban from 1986 through 1996.

Mr. Brinkworthhas served as Vice President — Supply since May 2005. Mr. Brinkworth joined Suburban in April 1997 after a nine-year career with Goldman Sachs (where he last served as Vice-President of Commodity Trading) and, since joining Suburban, has served in various positions in the supply area, most recently as Managing Director.

Mr. Keatinghas served as Vice President — Human Resources and Administration since July 1996. He previously held senior human resource positions at Hanson Industries and Quantum.

Mr. Wienberghas served as Vice President —– Operational PlanningPlanning) since October 2007. Prior to that he served as our Managing Director, Financial Planning and Analysis from October 2003 to October 2007 and as Director, Financial Planning and Analysis from July 2001 to October 2003. Prior to joining Suburban, Mr. Wienberg was Assistant Vice President —– Finance of International Home Foods Corp., a consumer products manufacturer.

Mr. ScanlonbecameKuglin has served as our Chief Financial Officer & Chief Accounting Officer since September 2014 and was our Vice President — Information Services in November 2008.– Finance and Chief Accounting Officer from April 2014 through September 2014. Prior to that he served as Assistantour Vice President — Information Servicesand Chief Accounting Officer since November 2007, Managing Director — Information Services from2011, our Controller and Chief Accounting Officer since November 2002 to November 20072009 and Director — Information Services from April 1997 until November 2002. Prior to joining Suburban, Mr. Scanlon spent several years with JP Morgan & Co., most recently as Vice President — Corporate Systems and earlier held several positions with Andersen Consulting (“Accenture”), an international systems consulting firm, most recently as Manager.

Mr. Kuglinhas served asour Controller since October 2007. For the eight years prior to joining Suburban he held several financial and managerial positions with Alcatel-Lucent, a global communications solutions provider. Prior to Alcatel-Lucent, Mr. Kuglin held several positions with the international accounting firm PricewaterhouseCoopers LLP, most recently as Manager in the Assurance practice. Mr. Kuglin is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants.

Mr. Abel has served as our General Counsel and Secretary since June 2006, was additionally made a Vice President in October 2007 and a Senior Vice President in April 2014. Prior to joining Suburban, Mr. Abel served as senior in-house legal counsel (including as a General Counsel) for several technology companies.

Mr. Boyd has served as our Senior Vice President – Field Operations since April 2014; previously he was our Vice President – Field Operations (formerly Vice President – Operations) since October 2008. Prior to that he was our Southeast and Western Area Vice President since March 2007, Managing Director – Area Operations since November 2003 and Regional Manager – Northern California since May 1997. Mr. Boyd held various managerial positions with predecessors of Suburban from 1986 through 1996.

Mr. Brinkworth has served as our Senior Vice President – Product Supply, Purchasing & Logistics since April 2014 and was previously our Vice President – Product Supply (formerly Vice President – Supply) since May 2005. Mr. Brinkworth joined Suburban in April 1997 after a nine year career with Goldman Sachs and, since joining Suburban, has served in various positions in the product supply area.

Mr. Keating has served as our Senior Vice President since October 2014 and before that was our Senior Vice President – Administration since July 2009. From July 1996 to that date he was our Vice President – Human Resources and Administration. He previously held senior human resource positions at Hanson Industries (the United States management division of Hanson plc, a global diversified industrial conglomerate) and Quantum.

Mr. Scanlon became our Senior Vice President – Information Services in April 2014, after serving as our Vice President – Information Services since November 2008. Prior to that he served as our Assistant Vice President – Information Services since November 2007, Managing Director – Information Services from November 2002 to November 2007 and Director – Information Services from April 1997 until November 2002. Prior to joining Suburban, Mr. Scanlon spent several years with JP Morgan & Co., most recently as Vice President – Corporate Systems and earlier held several positions with Andersen Consulting, an international systems consulting firm, most recently as Manager.

Mr. D’Ambrosio has served as our Treasurer since November 2002 and was additionally made a Vice President in October 2007. He served as our Assistant Treasurer from October 2000 to November 2002 and as Director of Treasury Services from January 1998 to October 2000. Mr. D’Ambrosio joined Suburban in May 1996 after ten years in the commercial banking industry.

Ms. Zwickel has served as our Vice President – Human Resources since November 2013. Prior to that, she was our Assistant Vice President – Human Resources since April 2011 and earlier held several roles in Suburban’s Legal Department (including Assistant General Counsel from October 2009 to April 2011 and Counsel from October 2002 to October 2009), where she was responsible for, among other things, providing legal counsel on employment issues. Ms. Zwickel joined Suburban in June 1999 after eight years in the private practice of law.

Mr. Bloomstein joined Suburban as its Controller in April 2014. For the ten years prior to joining Suburban, he held several executive financial and accounting positions with The Access Group, a network of professional services companies, and with Dow Jones & Company, Inc., a global news and financial information company. Mr. Bloomstein started his career with the international accounting firm PricewaterhouseCoopers LLP, working his way to the level of Manager in the Assurance/Business Advisory Services practice. Mr. Bloomstein is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants.

PARTNERSHIP GOVERNANCE

Our PartnershipThe MLP Agreement provides that all management powers over our business and affairs are exclusively vested in our Board of Supervisors and, subject to the direction of the Board of Supervisors, our officers. No Unitholder has any management power over our business and affairs or actual or apparent authority to enter into contracts on behalf of or otherwise to bind us.

Board Committees

The Board has twothree standing committees: an Audit Committee, a Compensation Committee and a CompensationNominating/Governance Committee. Because the Board of

Audit Committee

Four Supervisors consists of only seven members (six members(which number will be reduced to three following Mr. Mecum’s retirement at the conclusion of the Meeting), Suburban feels it is not necessary to have a separate nominating committee. Rather, the full Board participates in the selection of nominees to serve as Supervisors.

Audit Committee

Five Supervisors, who are not officers or employees of Suburban or its subsidiaries, serve on the Audit Committee with authority to review, approve or ratify, at the request of the Board,

of Supervisors, specific matters as to which the Board

of Supervisors believes there may be a conflict of interest, or which may be required to be disclosed pursuant to Item 404(a) of

Regulation S-K adopted by the Securities and Exchange

Commission, in order to determine if the resolution or course of action in respect of such conflict proposed by the Board of Supervisors is fair and reasonable to us. Under the PartnershipMLP Agreement, any matter that receives the “Special Approval” of the Audit Committee (i.e., approval by a majority of the members of the Audit Committee) is conclusively deemed to be fair and reasonable to us, is deemed approved by all of our partners and shall not constitute a breach of the PartnershipMLP Agreement or any duty stated or implied by law or equity as long as the material facts known to the party

8

having the potential conflict of interest regarding that matter were disclosed to the Audit Committee at the time it gave Special Approval. The Audit Committee also assists the Board of Supervisors in fulfilling its oversight responsibilities relating to:to (a) integrity of Suburban’s financial statements and internal control over financial reporting; (b) Suburban’s compliance with applicable laws, regulations and its code of conduct; (c) independence and qualifications of the independent registered public accounting firm; (d) performance of the internal audit function and the independent registered public accounting firm; and (e) accounting complaints.

Mr. Collins had previously advised the Board of Supervisors that he served on the audit committees of four public companies, including Suburban. In accordance with the rules of the New York Stock Exchange (“NYSE”), the Board of Supervisors had determined that Mr. Collins’ simultaneous service on four audit committees would not impair his ability to effectively serve on the Audit Committee of Suburban’s Board of Supervisors. Mr. Collins has advised the Board of Supervisors that as a result of one of those companies “going private,” as of May 22, 2009 he serves on the audit committees of three public companies, including Suburban.

Our Board has adopted a written charter for the Audit Committee, which is reviewed periodically to ensure that it meets all applicable legal and NYSE listing requirements. A copy of our Audit Committee Charter is available without charge from our website atwww.suburbanpropane.com or upon written request directed to: Investor Relations, Suburban Propane Partners, L.P., P.O. Box 206, Whippany, New Jersey07981-0206.

The Board of Supervisors has determined that all fivefour current members of the Audit Committee, Lawrence C. Caldwell, John D. Collins (its Chairman), Harold R. Logan, Jr., John Hoyt Stookey, Dudley C. Mecum and Jane Swift, are independent and (with the exception of Ms. Swift) are audit committee financial experts and are independent within the meaning of the NYSE corporate governance listing standards and applicable Securitiesin accordance with Rule 10A-3 of the Exchange Act, Item 407 of Regulation S-K and Exchange Commission rulesSuburban’s criteria for Supervisor independence set forth below as of the date of this Proxy Statement.

The Corporate Governance Guidelines and Principles adopted by the Board of Supervisors (and available on our website atwww.suburbanpropane.com) set forth that a Supervisor is deemed to be lacking a material relationship to Suburban and is therefore independent if the following criteria are satisfied:

1. Within the past three years, the Supervisor:

a. has not been employed by Suburban and has not received more than $100,000 per year in direct compensation from Suburban, other than Supervisor and committee fees and pension or other forms of deferred compensation for prior service;

b. has not provided significant advisory or consultancy services to Suburban, and has not been affiliated with a company or a firm that has provided such services to Suburban in return for aggregate payments during any of the last three fiscal years of Suburban in excess of the greater of 2% of the other company’s consolidated gross revenues or $1 million;

c. has not been a significant customer or supplier of Suburban and has not been affiliated with a company or firm that has been a customer or supplier of Suburban and has either made to Suburban or received from Suburban payments during any of the last three fiscal years of Suburban in excess of the greater of 2% of the other company’s consolidated gross revenues or $1 million;

d. has not been employed by or affiliated with an internal or external auditor that within the past three years provided services to Suburban; and

e. has not been employed by another company where any of Suburban’s current executives serve on that company’s compensation committee;

2. The Supervisor is not a spouse, parent, sibling, child, mother- orfather-in-law, son- ordaughter-in-law or brother- orsister-in-law of a person having a relationship described in 1. above nor shares a residence with such person;

3. The Supervisor is not affiliated with a tax-exempt entity that within the past 12 months received significant contributions from Suburban (contributions of the greater of 2% of the entity’s consolidated gross revenues or $1 million are considered significant); and

9

| 1. | Within the past three years, the Supervisor: |

| a. | has not been employed by Suburban and has not received more than $100,000 per year in direct compensation from Suburban, other than Supervisor and committee fees and pension or other forms of deferred compensation for prior service; | |

| b. | has not provided significant advisory or consultancy services to Suburban, and has not been affiliated with a company or a firm that has provided such services to Suburban in return for aggregate payments during any of the last three fiscal years of Suburban in excess of the greater of 2% of the other company’s consolidated gross revenues or $1 million; | |

| c. | has not been a significant customer or supplier of Suburban and has not been affiliated with a company or firm that has been a customer or supplier of Suburban and has neither made to Suburban nor received from Suburban payments during any of the last three fiscal years of Suburban in excess of the greater of 2% of the other company’s consolidated gross revenues or $1 million; | |

| d. | has not been employed by or affiliated with an internal or external auditor that within the past three years provided services to Suburban; and | |

| e. | has not been employed by another company where any of Suburban’s current executives serve on that company’s compensation committee; | |

| 2. | The Supervisor is not a spouse, parent, sibling, child, mother- or father-in-law, son- or daughter-in- law or brother- or sister-in-law of a person having a relationship described in 1. above nor shares a residence with such person; |

| 3. | The Supervisor is not affiliated with a tax-exempt entity that within the past 12 months received significant contributions from Suburban (contributions of the greater of 2% of the entity’s consolidated gross revenues or $1 million are considered significant); and |

4. The Supervisor does not have any other relationships with Suburban or with members of senior management of Suburban that the Board determines to be material.

| 4. | The Supervisor does not have any other relationships with Suburban or with members of senior management of Suburban that the Board determines to be material. |

Mr. Logan, Chairman of the Board, presides at the regularly scheduled executive sessions of the non-management Supervisors, all of whom are independent, held as part of the meetings of the Audit Committee.Board. Investors and other parties interested in communicating directly with the non-management Supervisors as a group may do so by writing to the Non-Management Members of the Board of Supervisors,c/o PartnershipCompany Secretary, Suburban Propane Partners, L.P., P.O. Box 206, Whippany, New Jersey07981-0206.

The Board will continue to review the qualifications of the members of the Audit Committee in light of the evolving requirements of the Sarbanes-Oxley Act of 2002, the Securities and Exchange Commission regulations and the NYSE listing requirements. The committee met 8eight times during fiscal 2008.

2014.Compensation Committee

The Compensation Committee reviews the performance and sets the compensation for all executives. It also approves the design of executive compensation programs. In addition, the Compensation Committee participates in executive succession planning and management development. The committee met 2three times during fiscal 2008.2014. Its members are Matthew J. Chanin, Harold R. Logan, Jr. and John Hoyt Stookey (its Chairman), Harold R. Logan, Jr., John D. Collins, Dudley C. Mecum and Jane Swift, noneall of whom are officers or employeesindependent in accordance with our Corporate Governance Guidelines and Principles and the rules of Suburban.

the NYSE.Our Board has adopted a Compensation Committee Charter. A copy of our Compensation Committee Charter is available without charge from our website atwww.suburbanpropane.com or upon written request directed to: Investor Relations, Suburban Propane Partners, L.P., P.O. Box 206, Whippany, New Jersey07981-0206.

Supervisor NominationsNominating/Governance Committee

The Nominating/Governance Committee participates in Board succession planning and Criteriadevelopment and identifies individuals qualified to become Board members, recommends to the Board the persons to be nominated for election as Supervisors at any Tri-Annual Meeting of the Unitholders and the persons (if any) to be elected by the Board Membership

to fill any vacancies on the Board, develops and recommends to the Board changes to Suburban’s Corporate Governance Guidelines and Principles when appropriate, and oversees the evaluation of the Board. The

Committee has met 2 times since it was created by the Board at its July 22, 2014 meeting (prior to such date, the full Board

of Supervisors, fiveperformed the functions now assumed by the Nominating/Governance Committee). Its members are Lawrence C. Caldwell, Matthew J. Chanin, John D. Collins, Harold R. Logan, Jr. (its Chairman), Dudley C. Mecum, John Hoyt Stookey and Jane Swift, all of whom are independent in accordance with our Corporate Governance Guidelines and Principles and the rules of the

NYSE, participates in the considerationNYSE. Mr. Mecum’s membership on this Committee will not be filled upon expiration of

his current term as a Supervisor.Our Board has adopted a Nominating/Governance Committee Charter. A copy of our Nominating/Governance Committee Charter is available without charge from our website atwww.suburbanpropane.com or upon written request directed to: Investor Relations, Suburban Propane Partners, L.P., P.O. Box 206, Whippany, New Jersey 07981-0206.

Supervisor nominees. There is no charter governing the nomination process. Nominations and Criteria for Board Membership

To fulfill its responsibility to recruit nominees for election as Supervisors, the Board of SupervisorsNominating/Governance Committee reviews the composition of the Board to determine the qualifications and areas of expertise needed to further enhance the composition of the Board and works with management in attracting candidates with those qualifications. Appropriate criteriaOur Corporate Governance Guidelines and Principles set forth the following minimum qualifications for our Supervisors, who are nominated in accordance with the procedures set forth in the MLP Agreement:

1. Integrity.Individuals must be of personal and professional integrity and ethical character, who recognize and value these qualities in others.

2. Absence of Conflicts of Interest.In addition to meeting the independence standards set forth elsewhere in the Guidelines, a Supervisor should not have any interests that would materially impair his or her ability to (i) exercise independent judgment or (ii) otherwise discharge the fiduciary duties owed as a supervisor to Suburban and its unitholders.

3. Fair and Equal Representation.A Supervisor must be able to represent fairly and equally the long-term interests of all of Suburban’s unitholders without favoring or advancing any particular unitholder or other constituency of Suburban.

4. Achievement.A Supervisor must have demonstrated achievement in one or more fields of business, professional, or governmental endeavor.

5. Oversight.A Supervisor is expected to have sound judgment, borne of management or policy-making experience (which may be as an advisor or consultant), that demonstrates an ability to function effectively in an oversight role (including an inquisitive and rigorous manner of monitoring).

6. Experience and Business Understanding.A Supervisor should have relevant or relatable expertise and experience, and be able to offer advice and guidance to management based on that expertise and experience. In addition, he/she must have a general appreciation regarding key issues facing public companies of a size and operational scope similar to Suburban, including:

| — | | corporate governance concerns; |

| — | | regulatory obligations of a public issuer; |

| — | | strategic business planning; and |

| — | | basic concepts of corporate finance. |

7. Available Time.A Supervisor must have sufficient time available to devote to the affairs of the Board, membershipbe fully prepared to devote such time, and be physically and mentally capable of devoting such time. It is expected that each candidate will be available and able to attend substantially all meetings of the Board and any committees on which he/she will serve, as well as Suburban’s tri-annual and special meetings of unitholders, after taking into consideration his/her other business and professional commitments, including service on the boards of other companies. The Board should include at a minimum,least some supervisors who are committed to service on the following:

| | |

| • | Members of the Board should be individuals of high integrity, independence and substantial accomplishments, and should have prior or current association with institutions noted for their excellence. |

|

| • | Members of the Board should have demonstrated leadership ability with diverse perspectives, the ability to exercise sound business judgment and broad experience in areas important to the operation of Suburban. |

|

| • | Supervisors must act ethically at all times. |

Board for an extended period of time.8. Diversity.The Board seeks an appropriate diversity of personal and professional background, experience, expertise, and perspective among Supervisors. Board Supervisors should be able to cooperate with other Board members and contribute to the collegiality of the Board.

In addition, the BoardNominating/Governance Committee considers the number of other boards of public companies on which a candidate serves.

The Board considersUnitholders may nominate candidates for Supervisor suggested by our Unitholders, provided that the recommendations are madeSupervisors in accordance with the following procedures set forth in the PartnershipMLP Agreement. Any Unitholder (or group of Unitholders) that beneficially owns 10% or more of the outstanding Common Units is entitled to nominate one or more individuals to stand for election as Supervisors at a Tri-Annual Meeting by providing written notice thereof to the Board of Supervisors not more than 120 days and not less than 90 days prior to the date of such Tri-Annual Meeting; provided, however, that in the event that the date of the Tri-Annual Meeting was not publicly announced by Suburban by mail, press release or otherwise more than 100 days prior to the date of such meeting, such notice, to be timely, must be delivered to the Board of Supervisors not later than the close of business on the 10th day following the date on which the date of the Tri-Annual Meeting was announced. The notice must set forth (i) the name and address of the Unitholder(s) making the nomination or nominations, (ii) the number of Common

10

Units beneficially owned by such Unitholder(s), (iii) such information regarding the nominee(s) proposed by the Unitholder(s) as would be required to be included in a proxy statement relating to the solicitation of proxies for the election of Supervisors filed pursuant to the proxy rules of the Securities and Exchange Commission had the nominee(s) been nominated or intended to be nominated to the Board of Supervisors, (iv) the written consent of each nominee to serve as a member of the Board of Supervisors if so elected and (v) a certification that such nominee(s) qualify as Supervisor(s). Unitholder nominees whose nominations comply with these procedures and who meet the minimum criteria for Board membership, as outlined above, will be evaluated by the Board of SupervisorsNominating/Governance Committee in the same manner as the Board’sCommittee’s nominees.

Attendance at Meetings

It is the policy of the Board of Supervisors that all Supervisors should attend Suburban’s Unitholder meetings. All fivesix of the then Supervisors attended the Tri-Annual Meeting of Unitholders on May 1, 2012, which was subsequently adjourned until May 14, 2012 for lack of a quorum. When that meeting re-convened on May 14, all of the then Supervisors, other than Mr. Stookey, were in October 2006.

attendance.Board and Committee Meetings

The Board held 125 meetings in fiscal 2008.2014. Each Supervisor attended at least 75% of the total number of meetings of the Board and of the Committees of the Board on which such Supervisor served.

Unitholder Communications Withwith the Board of Supervisors

Unitholders who wish to communicate directly with the Board as a group may do so by writing to the Suburban Board of Supervisors,c/o PartnershipCompany Secretary, Suburban Propane Partners, L.P., P.O. Box 206, Whippany, New Jersey07981-0206. Unitholders may also communicate directly with individual Supervisors by addressing their correspondence accordingly.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act, of 1934, as amended, requires our Supervisors, executive officers and holders of 10 percent or more of our Common Units to file initial reports of ownership and reports of changes in ownership of our Common Units with the Securities and Exchange Commission. Supervisors, executive officers and 10 percent Unitholders are required to furnish Suburban with copies of all Section 16(a) forms that they file. Based on a review of these filings, we believe that all such filings were timely made during fiscal 2008.

Code of Ethics and Code of Business Conduct and Ethics

We have adopted a Code of Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, and a Code of Business Conduct and Ethics that applies to all of our employees, officers and Supervisors. Copies of our Code of Ethics and our Code of Business Conduct and Ethics are available without charge from our website atwww.suburbanpropane.com or upon written request directed to: Investor Relations, Suburban Propane Partners, L.P., P.O. Box 206, Whippany, New Jersey07981-0206. Any amendments to, or waivers from, provisions of our Code of Ethics or our Code of Business Conduct and Ethics that apply to our principal executive officer, principal financial officer and principal accounting officer will be posted on our website.

Corporate Governance Guidelines

We have adopted Corporate Governance Guidelines and PoliciesPrinciples in accordance with the NYSE corporate governance listing standards in effect as of the date of this Proxy Statement. Copies of our Corporate Governance Guidelines and Principles are available without charge from our website atwww.suburbanpropane.com or upon written request directed to: Investor Relations, Suburban Propane Partners, L.P., P.O. Box 206, Whippany, New Jersey07981-0206.

11

NYSE Annual CEO Certification

The NYSE requires the Chief Executive Officer of each listed company to submit a certification indicating that the company is not in violation of the Corporate Governance listing standards of the NYSE on an annual basis. Our Chief Executive Officer submits his Annual CEO Certification to the NYSE each December. In December 2014, Mr. AlexanderStivala submitted his Annual CEO Certification for 2008our 2014 fiscal year to the NYSE without qualification.

REPORT OF THE AUDIT COMMITTEE